Bitcoin held its ground over the weekend as US President Donald Trump said late Saturday that he was increasing a recently announced global tariff from 10% to 15% and that the new rate would take effect immediately.

The move came after the US Supreme Court ruled to limit the legal authority previously used to impose broad import levies.

Bitcoin Unmoved

Cryptocurrencies barely budged on the news. Bitcoin hovered around the $68,000 mark while Ether showed little change, and smaller tokens lost under 1% in aggregate according to market trackers. Reports note that traders only saw a brief wobble before prices steadied, suggesting the shock was short lived.

Legal Limits And What They Mean

Based on reports, the shift to alternative trade laws limits how far a president can go with such tariffs. The statutes cited allow a temporary tariff capped at 15% and typically apply to countries where the US runs a trade deficit for a defined period of up to 150 days.

Legal experts say those constraints could keep the measure from becoming a permanent tax rise on imports.

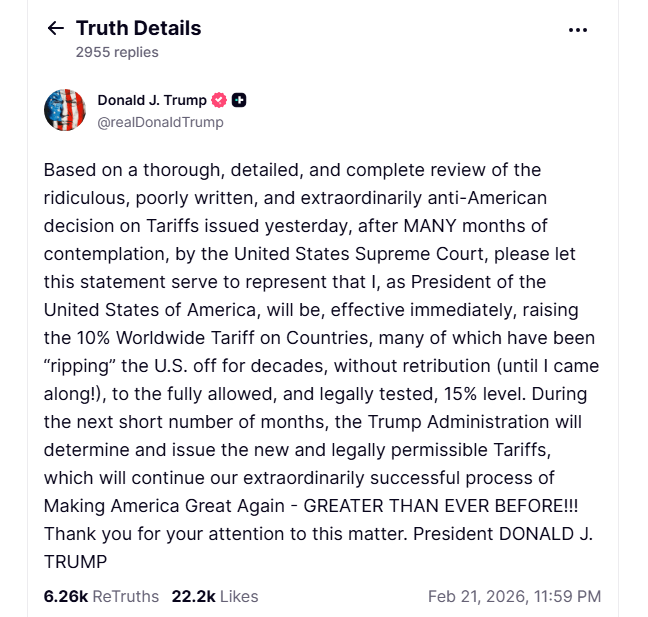

Trump said on his Truth Social platform:

“As President of the United States of America, I will be, effective immediately, raising the 10% worldwide tariff on countries, many of which have been ‘ripping’ the US off for decades, without retribution, until I came along, to the fully allowed, and legally tested, 15% level.”

How Traders Might Be Thinking

Some investors appear to have treated the announcement as a headline event rather than the start of a lasting economic shock.

Volume patterns showed no sustained sell pressure, and risk appetite in crypto markets returned quickly. Reports say the earlier court ruling, which narrowed the executive branch’s emergency powers for tariffs, may have removed some uncertainty — at least for now.

Market sentinels will watch closely in the days ahead. If the White House tries to stretch the temporary authority or expand the list of targeted countries, that could change the tone in both crypto and equity markets.

Bigger Picture For The Economy

Raising an across-the-board tariff, even temporarily, raises questions about costs for businesses and consumers.

Import duties are often passed down the chain in the form of higher prices or tightened margins, and global trading partners are likely to push back diplomatically and legally.

Some foreign leaders and industry groups quickly criticized the move, warning it could slow growth and raise consumer bills.

Far from a market-draining shock, this episode so far reads like a high-profile policy stunt with limited immediate market effect.

That could change if the measure is stretched beyond the legal limits that lawmakers and courts have pointed to. For now, crypto traders seem to have chosen to watch and wait while prices remain near recent highs.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Credit: Source link