Key Highlights

- Brian Armstrong, CEO of Coinbase, has highlighted the fundamental problems in global wealth creation, where capital markets support the wealthy and labor income lags

- He proposed that tokenization can provide a solution to this problem in global wealth creation

- According to the report, the top 10% holds 75% of personal wealth, while the bottom 50% owns just 2%

In the latest post shared on X (formerly Twitter), Coinbase CEO Brian Armstrong has highlighted fundamental problems in how wealth is created and distributed globally.

(Source: Brian Armstrong on X)

Armstrong shared his view that current capital markets mostly benefit those who are already wealthy and leave billions of people behind. He identified a growing chasm where incomes from labor fail to keep pace with gains from capital investments.

According to Armstrong, tokenization can provide a solution to this systemic inequality.

Tokenization is the process of converting rights to physical or financial assets into a digital token on a blockchain. Armstrong affirmed that this technology can allow people anywhere to own fractions of valuable assets, from real estate to company shares, without needing large amounts of starting capital.

World Suffers from Global Wealth Inequality

The World Inequality Report 2026 unveiled a shocking picture of wealth distribution around the world. According to the report, the wealthiest 10% of the global population owns 75% of all personal wealth.

On the flip side, the bottom 50% only controls 2% wealth. This concentration of wealth has increased over time. Since 1995, the top 0.001% has seen their share of global wealth grow from 4% to over 6%.

The top 10% holds 53% of all global income, while the bottom half of humanity receives only 8%, a decline from 14% in the year 1920.

Recent reports have also revealed the growth in wealth inequality. Oxfam’s 2025 analysis noted that billionaire wealth surged by 16% to reach $18.3% trillion, growing three times faster than the recent 5-year average. The organization reported that the $2.5 trillion increase in billionaire fortunes in 1 year alone could theoretically end extreme poverty 26 times over.

Capital Gains Overshadows Labor, Leaving Most People Behind

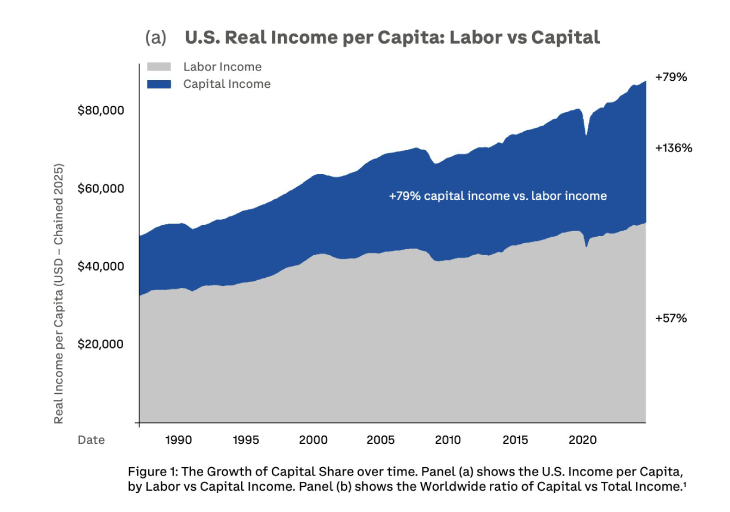

The main reason behind this disparity in global wealth is the overwhelming advantage of capital income over labor income. Wealth generated from investments is compounding far more rapidly than wages.

“Over the past four decades, these two engines have diverged dramatically. In the United States, labor income has increased by 57%, while capital income has skyrocketed by 136%. This 80-point gap is not merely a statistic; it compounds over a lifetime, creating a significant divide between those who can invest and those who cannot,” stated in the Coinbase report.

The UBS Global Wealth Report revealed that while global wealth grew by 4.6% in 2024, this growth was heavily biased. It mainly came from North American markets, where average adult wealth reached $593,347, which is far more than levels in Asia-Pacific and EMEA regions.

Worldwide Adoption of Tokenization Soars

Amid the boom in the digital asset market, Armstrong has highlighted the explosive growth and growing institutional adoption of tokenization.

According to Broadridge, over 300 institutions found that 63% of custodians already offer tokenized assets, with another 30% planning to do so within the next 2 years.

The market for tokenized real-world assets (RWAs) has soared. Major financial institutions are interested in this new concept. For example, BlackRock’s BUIDL tokenized Treasury fund, for example, holds over $2.5 billion. Overall, the value of tokenized U.S. Treasuries reached $7.4 billion by mid-2025, which is an 80% increase since the start of the year.

Analysis by Deutsche Bank Research shows that new tokenized asset issuance soared from $59.7 million in 2018 to approximately $300 billion by October 2025.

Credit: Source link