- The Cardano price drives a steady downtrend consolidating within the formation of a falling wedge pattern.

- The $0.24 stands as a major accumulation support zone for ADA holders.

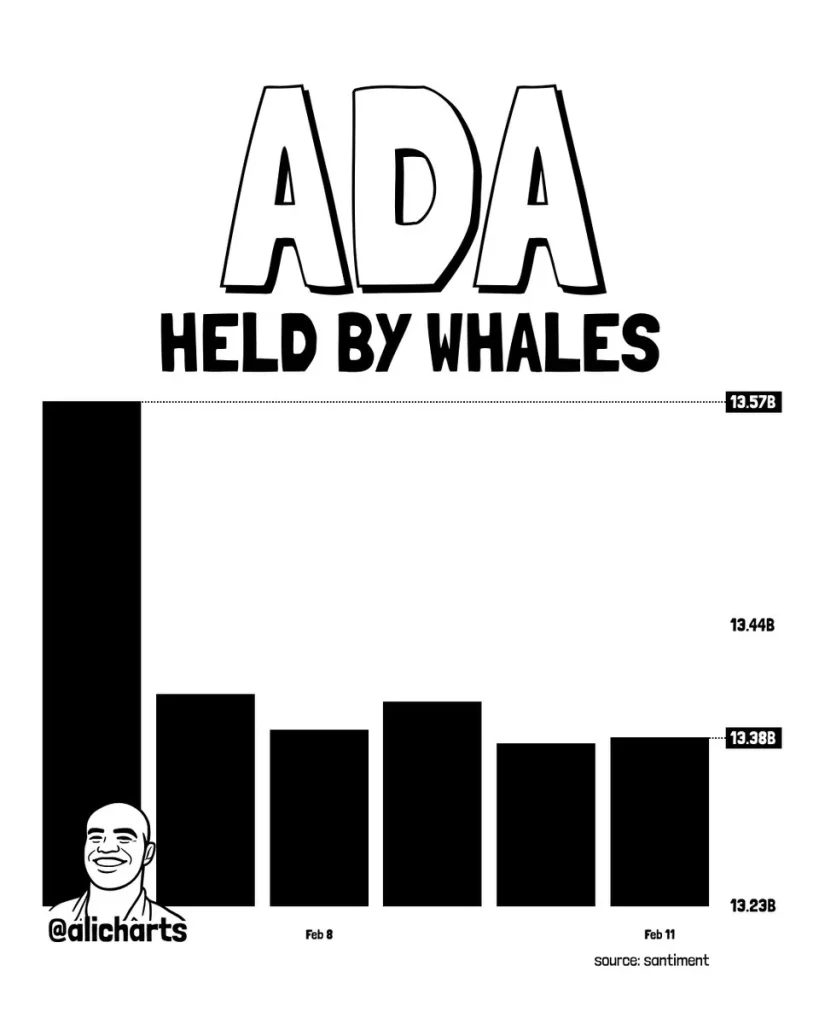

- Whale investors redistributed more than 190 million ADA tokens over the past week.

ADA, the native cryptocurrency of the Cardano ecosystem, is gradually drifting toward $0.24 support amid broader market weakness. Today, the Cardano price is down 2.27% and macroeconomic jitters continue to put additional pressure on these cryptocurrencies. With sustained selling, the coin price has developed a key reversal pattern that could bolster buyers to regain their grip over this asset. Will ADA regain the $0.3 mark?

ADA Stalls at $0.285 as Whales Offload 190M Tokens

Cardano’s rebound from last week’s sell-off witnessed an immediate wall at $0.285 mark. The renewed selling pressure at this resistance has gradually pushed the asset price to $0.257, suggesting a lack of conviction from buyers to build a sustainable recovery.

CME Group has launched futures contracts for Cardano (ADA) on February 9, 2026, in addition to those for Chainlink and Stellar. These instruments, in both standard and micro sizes, are aimed at offering institutional participants instruments for understanding how to deal with exposure in a structured environment.

Rather than causing sustained buying, the rollout coincided with significant downward movement in ADA’s spot price, which fell around 3-4% in the immediate period, to prices near $0.25-$0.26, which coincided with softness in the overall market. Pre-launch positioning seems to have turned around soon, contributing to the disposal of holdings.

In a recent tweet, market analyst Ali Martinez highlighted that over 190 million ADA tokens were redistributed by whales in the past week according to Santiment data. Historically, such sale of heavy supply has conceded with major market top or aggressive selling pressure in price.

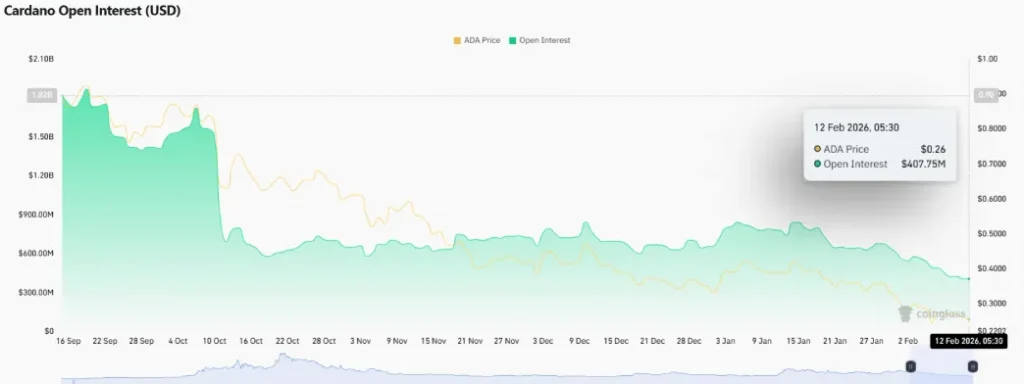

In addition, the derivatives market data also accentuates lower engagement from crypto traders. According to Coinglass data, the open interest tied to Cardano’s futures witnessed a sharp drop from $841 million to $407 million, registering a loss of 51%.

This downtick primarily triggered due to cascading liquidation from broader market sell-off. However, if the downtrend remains intact, it would indicate the traders are still hesitant to enter a leverage position in the market.

Cardano Price Poised For Breakout From this Reversal Pattern

Since last month, the Cardano price has witnessed a significant correction from $0.429 to $0.225, accounting for a 40%. This downturn, backed by a steady increase in trading volume accentuates the strong conviction from sellers to drive a prolonged correction.

In addition, the daily chart analysis shows the price movement remains strictly within two downsloping trendlines, indicating the formation of a falling wedge pattern. This chart setup is commonly spotted at the end of downtrend as the converging nature trendlines indicate that the bearish momentum is gradually depleting.

The 20-day exponential moving average acts as dynamic resistance against occasional rebound in ADA price.

Following a recent rebound from the pattern’s bottom trendline at $0.24, the Cardano price is just 7.5% from challenging the pattern’s resistance trendline. A bullish breakout from this resistance could provide buyers a suitable support to drive higher recovery above $0.33 resistance.

On the contrary, if coin price faces renewed selling pressure at overhead trendline, the sellers could force a prolonged correction in price.

Also Read: Tom Lee Says Crypto Rally Hinges on Bitcoin to Gold Reversal

Credit: Source link