Key Highlights:

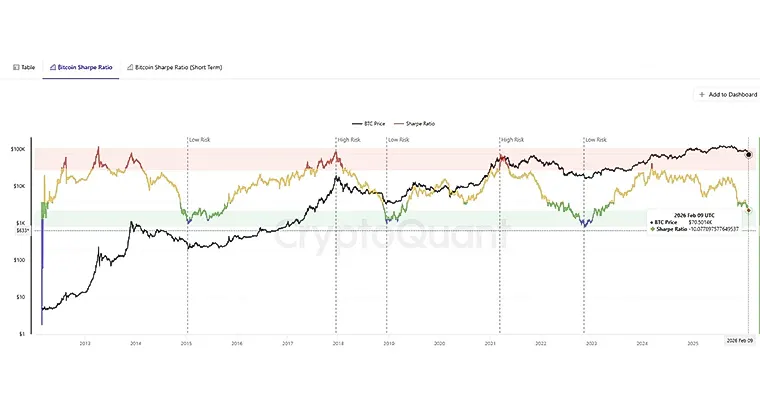

- Bitcoin’s Sharpe Ratio drops down to -10 today, February 9, 2026.

- This drop in Sharpe Ratio is similar to what was observed in 2018 and 2022.

- Past cycles show it can lead to eventual recovery, but not an immediate price bounce.

Bitcoin is currently offering very poor returns for the amount of risk investors are taking as the Sharpe Ratio just dropped down to -10 today, February 09, 2026, as per CryptoQuant. This level has been usually observed whenever there has been a major crash within the crypto market.

The last time this happened was back in 2018, when Bitcoin lost more than 80% of its value and in 2022 right after the FTX collapse, when BTC fell from about $69,000 to $16,000.

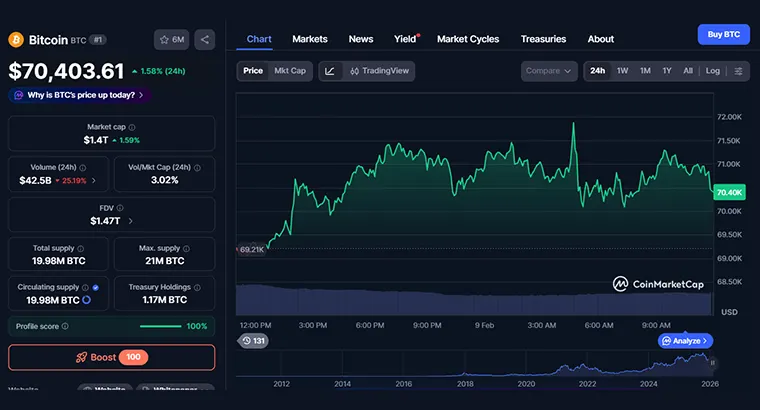

At press time, the price of the token stands at $70,403.61 with an uptick of 1.58% in the last 24-hours as per CoinMarketCap.

A Sharpe Ratio when hits such low levels it usually means that Bitcoin is swinging wildly in price but not rewarding investors for that risk. In simple terms, people are taking big risks, but the payoff just is not as much as it should be, something that is very common during the bear market.

What is Bitcoin’s Sharpe Ratio?

The Sharpe Ratio is a metric through which one can check whether an investment is worth the risk or not. In this metric, it compares how much money you make from an investment to how risky or shaking the price is at that time.

If an investment goes up steadily, it has a good Sharpe Ratio. If it jumps up and down a lot and does not give out a lot of profit, then the Sharpe Ratio becomes slow or even negative.

A number above 1 means the rewards are decent enough for the risk that is being taken. Anything below 0 means that the investors are taking a lot of risk without getting paid for it.

Historical Implications and Market Warning

When the Sharpe Ratio turns deeply negative, like today’s -10, it has usually happened near the worst parts of a bear market. As stated above, in the past, especially in 2018 and 2022, these moments showed that most investors had already given up, prices were oversold and even miners were struggling. After that, Bitcoin eventually started to recover over the following months.

That said, this doesn’t mean prices bounce back right away. In some cases, like 2019 and 2023, Bitcoin moved sideways for a long time before any real rally started.

Analysts say this phase represents maximum uncertainty, people are taking big risks by holding Bitcoin, but there’s little to no reward for doing so.

As of February 2026, the situation is even more uncertain. While President Trump’s pro crypto stance could help long-term sentiment, delays in clear rules or regulations may increase short-term price swings keeping volatility high.

Also Read: Bitcoin Crashes to $70K Amid Tech Panic and ETF Sell-Offs

Credit: Source link