- AAVE hovered just below $300 after bouncing from $213, shaking out short sellers hard.

- Open interest jumped 15% as traders leaned bullish, eyeing $305.71 as the next major target.

Aave (AAVE) climbed 1.28% on Wednesday, extending its previous day’s 3.45% gain. The recent uptick brought the token near the $300 zone, driven by rising market optimism and a surge in activity across the broader decentralized finance space.

Data from DeFiLlama shows Aave’s total value locked (TVL) reached a record $26.49 billion, setting a new high for the lending protocol.

That TVL boost followed rising market engagement, with total DeFi TVL climbing to $116.786 billion. This signals growing user confidence in decentralized lending platforms. Aave’s cumulative borrowing volume reached $775 billion. The protocol’s social media account posted “Trillions next,” hinting at expectations of continued growth in borrowing.

The token’s bullish movement is reinforced by technical indicators, with AAVE maintaining an upward trend after bouncing from the $213.55 mark, which aligns with the 50% Fibonacci retracement from its high in mid-December to the low in early April. The current uptrend targets the 78.6% retracement level at $305.71.

Market Sentiment Rises as Liquidations Support Price Climb

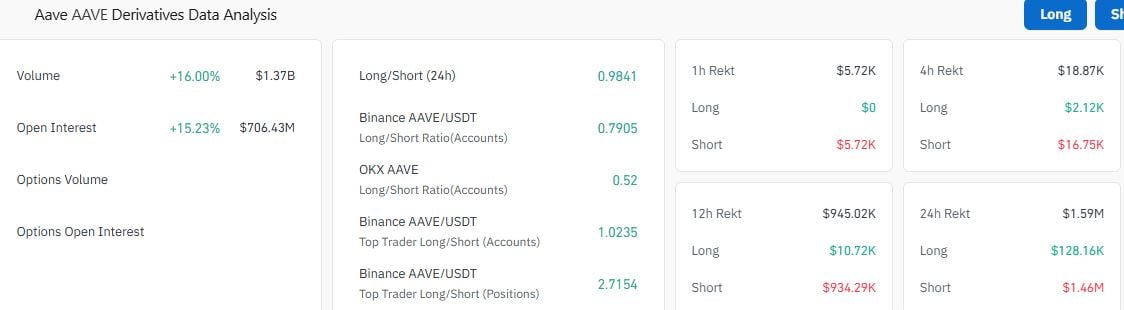

Liquidation data over the last 24 hours showed $1.59 million in total positions closed out. Of that, $1.46 million were from short trades, suggesting that the recent upward price action caught bearish traders. The long/short ratio stood nearly even at 1.0173, but still leaned in favor of longs, with 50.43% of positions betting on further upside.

Open Interest (OI) in AAVE futures climbed by 15.23% in 24 hours, reaching $706.43 million, according to CoinGlass. Higher OI often reflects greater capital inflows into the derivatives market, which, in this case, points to renewed bullish sentiment as traders seek exposure ahead of a potential breakout.

Meanwhile, AAVE hit a new monthly high after forming a V-shaped recovery pattern in late June. This uptrend coincides with key momentum indicators. The Relative Strength Index (RSI) is at 61, suggesting the asset is nearing overbought territory, and the MACD shows green bars above the zero line, reflecting increasing momentum.

Timing Patterns Suggest Aave’s Key Moves Still Ahead

With over two weeks remaining in July, market participants are closely watching for any new price triggers. Crypto analyst Jip Molenaar observed, “Around 58% of months the last 5 years form the first pivot early.” The second pivot typically forms in the final nine days of the month. That timing could align with current conditions as the market tests resistance near the $300–$310 zone.

A close above $305.71 could open the way for a run toward AAVE’s 52-week high of $399.85. However, if the trend weakens, support may reappear near the 50-day exponential moving average at $259.02.

With both borrowing activity and investor confidence rising, the market setup appears favorable for a retest of the $300 mark. All eyes are now on whether the strength in inflows and volume can hold long enough to break that level.

Credit: Source link