Pi Coin has come under intense scrutiny as recent data actually reveals that the core team currently controls about 82.8 billion coins, which certainly challenges Pi Network‘s decentralized blockchain claims. This substantial concentration of tokens establishes significant cryptocurrency security risks and also raises fundamental questions regarding the project’s authentic nature.

Also Read: Gold Price Hits $3,000 All-Time High Amid Record 2025

Explore Pi Coin’s Control, Decentralized Blockchain Concerns, and Cryptocurrency Risks

Pi Coin Distribution Reveals Centralization Concerns

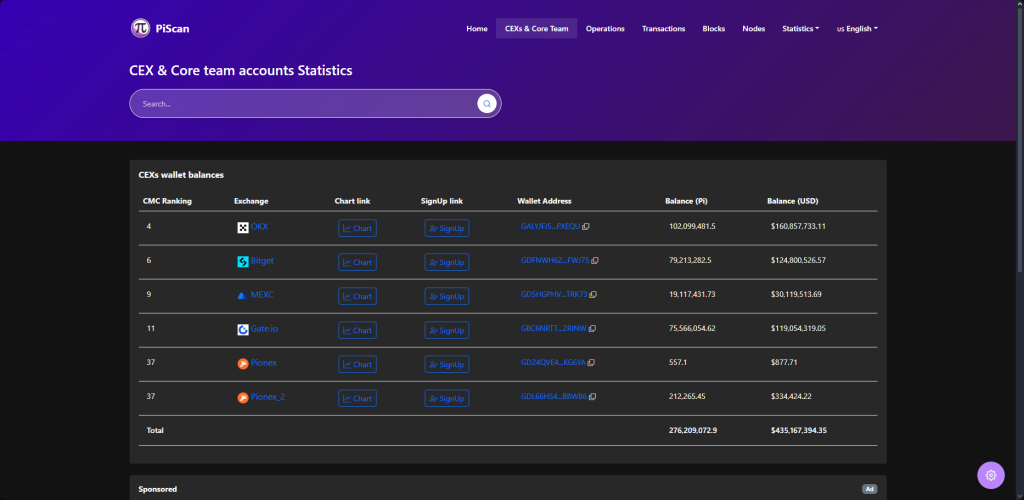

Pi Coin’s total supply is essentially capped at 100 billion tokens, right now. However, the latest comprehensive market analysis has revealed that approximately 82.8 billion Pi Coins remain under the core team’s direct control, and this is across several key financial channels. Specifically, around 62.8 billion coins are maintained in six distinct wallets connected to the team, while another 20 billion are distributed across roughly 10,000 wallets associated with Pi’s ongoing development efforts.

This pronounced concentration effectively contradicts Pi Network’s decentralized blockchain promises and subsequently generates multiple significant cryptocurrency security risks for numerous investors across various market segments.

Limited Validator Network for Pi Coin

Pi Network currently operates with just 43 nodes and, at the time of writing, only three active validators globally, which sharply contrasts with truly decentralized blockchain networks such as Bitcoin and Ethereum that function through thousands of independent nodes and stuff like that. Also, many experts have pointed out that this limited validator structure is unusual for a project of this size, and it kind of creates potential security concerns as well.

Also Read: XRP as America’s Strategic Asset? Ripple CEO’s Bold Move Explained

Pi Coin Price Volatility and Market Response

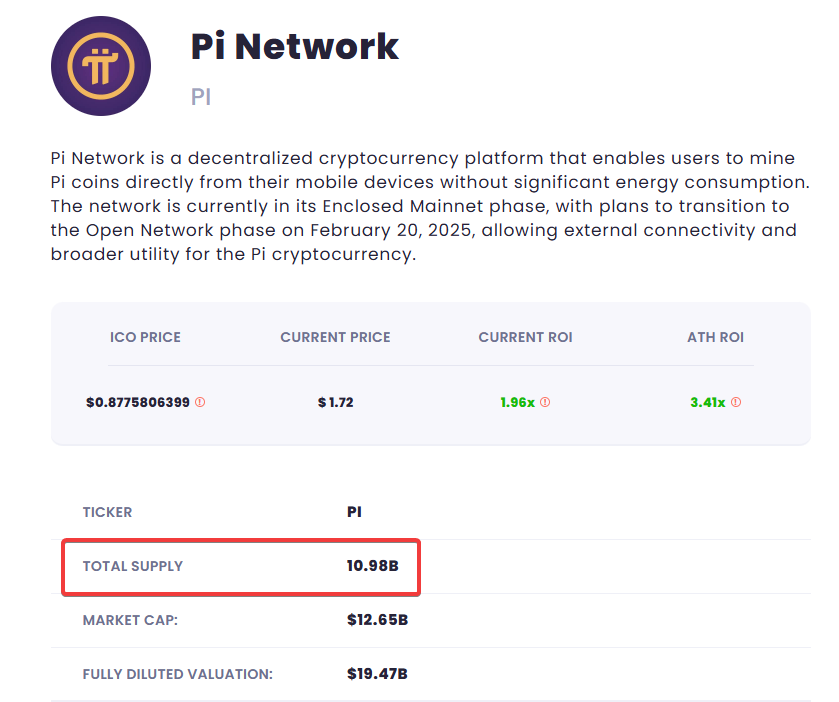

Since its mainnet launch back in the month of February, Pi Coin has experienced some considerable price fluctuations. The token initially reached a value of $2.99 before subsequently declining approximately 45% to around $1.71. Despite such volatility, Pi Coin’s market capitalization currently sits at about $12.26 billion, effectively positioning it as the 11th largest cryptocurrency in the global market.

Pi Network’s centralization issues have certainly contributed to the cryptocurrency security risks that investors face, furthermore amplifying the token’s market volatility across several key trading platforms.

Also Read: Dogecoin Prediction: AI Sets DOGE Price For March 20, 2025

Community Frustration Over Pi Token’s Governance

The Pi Coin community has increasingly showed growing frustration regarding token migration delays and a general lack of transparency. Users are questioning Pi Network’s decentralized blockchain claims more frequently as they report various difficulties when trying to transfer their mined Pi tokens.

The concentration of 82.8 billion Pi under core team control has led many participants to view the project as essentially centralized rather than the decentralized blockchain it originally claimed to establish across multiple essential cryptocurrency frameworks.

Conclusion

Pi Coin’s promise as an accessible cryptocurrency is substantially overshadowed by the core team’s control of 82.8 billion tokens. This significant concentration, coupled with limited validators and transparency concerns, fundamentally contradicts Pi Network’s decentralized blockchain claims and generates various cryptocurrency security risks for investors throughout numerous market segments. Unless the broader cryptocurrency community addresses these critical concerns, Pi will continue to face persistent doubts.

Credit: Source link