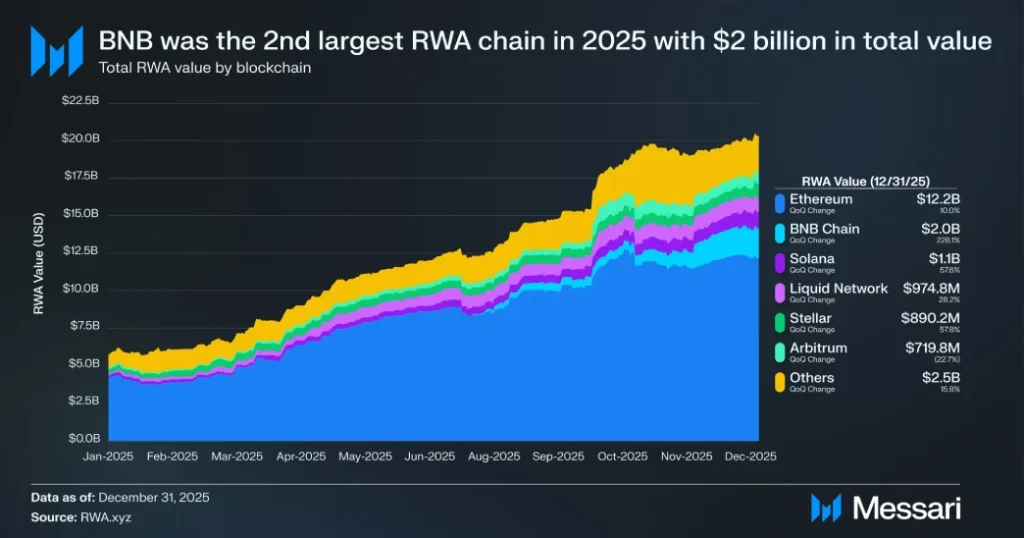

- BNB Chain recorded $2 billion in tokenized real-world assets (RWAs) by the end of 2025.

- The Binance coin price correction is testing the $600 psychological support amid weak bearish momentum, signaling an opportunity for a bullish rebound.

- The momentum indicator RSI (Relative Strength Index) at 29% suggests an oversold scenario for BNB holders.

BNB, the native token of the BNB Chain, witnessed a slight uptick of roughly 1% on Thursday, U.S. market hours, to hit $614 trading value. While the broader crypto market records a notable pullback, the Binance coin price shows resilience above its long-coming support at $600. Along with technical support, a recent report by Messari highlighted a substantial growth of the BNB Chain in the RWA sector, bolstering the asset’s long-term value.

BNB Chain Climbs RWA Rankings as Institutional Adoption Accelerates

BNB Chain had its tokenized real-world assets (RWAs) soar to $2 billion at the end of 2025, putting it at the #2 spot for blockchains in this category, second only to Ethereum, which had $12.2 billion. The number represented a sharp increase of 228% over the previous quarter’s $608 million, according to data tracked through December 31 and as analyzed in Messari’s review.

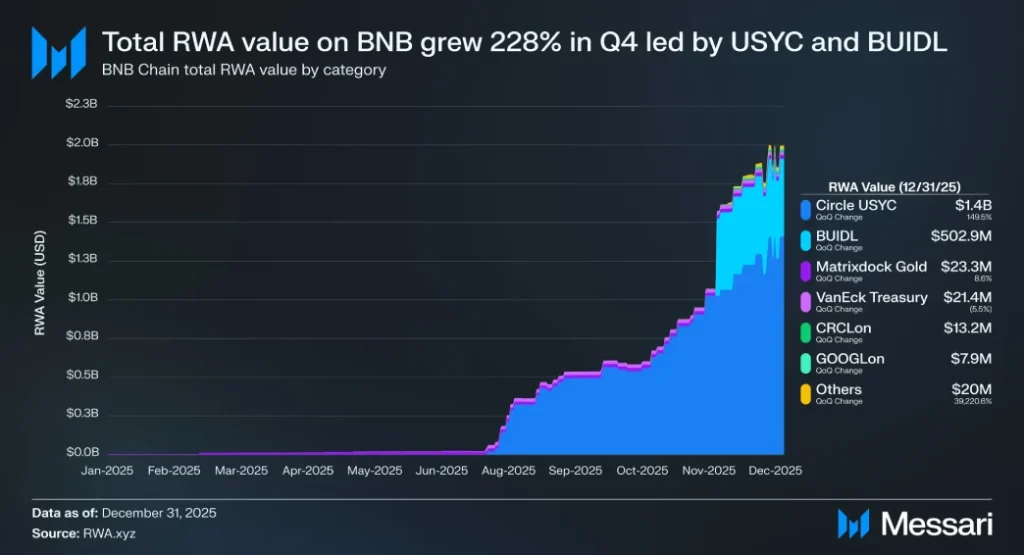

This expansion caused BNB Chain to climb to the top of the RWA value total above Solana and other networks. On the chain itself, the growth came from largely tokenized cash equivalents and funds. Circle’s USYC accounted for about $1.4 billion, and BlackRock’s BUILD fund contributed about $503 million, combined with a bulk increase over the last three months.

A number of institutional moves contributed to the uptick. A partnership with CMB International brought a tokenized money market fund with a value of $3.8 billion in early October. Later that month, Ondo Global Markets added more than 100 tokenized US stocks and ETFs, branching out from the traditional yield products. By mid-November, BlackRock’s BUIDL came to the chain and became accepted as collateral in Binance’s ecosystem.

These steps highlighted increased use of BNB Chain for bridging traditional finance with on-chain settlement, notably the settlement of instruments perceived as cash-like, and other asset classes. RWAs drive higher-onchain activity, transaction and stablecoin usage, notably bolstering the use case of the BNB token

Here’s Why BNB Price May Defend $600 Support

The Binance coin price has lost the entire gain it acquired during last week’s crypto market rebound. The coin price struggled to sustain above the $660 floor and gradually drifted lower to the current trade at $612.

Earlier today, the sellers forced a temporary dip below the psychological support of $600, signaling their attempt to drive a prolonged downtrend. However, the declining volume during the recent price fall shows a weak bearish momentum as the asset has already experienced a significant downtrend since last month.

The momentum indicator RSI at 24% further accelerates the oversold outlook on Binance coin, suggesting that the price needs a temporary halt to recoup its bearish momentum. Thus, the coin price is likely to hold $600 for the coming week and drive a short-term consolidation in the daily chart.

The post-consolidative move— a bearish breakdown from $600 or upside breakout to $672 could signal the upcoming trend in Binance coin price.

Also Read: Tom Lee Says Crypto Rally Hinges on Bitcoin to Gold Reversal

Credit: Source link