- The Chainlink price gives a decisive breakdown below the support trendline of a falling wedge pattern, signalling the risk of prolonged correction ahead.

- Capital rotation on the network has leaned outward, signaling redistribution rather than reinvestment.

- Oversold RSI hints that the LINK could witness a temporary pullback to $9 and recoup its exhausted bearish momentum.

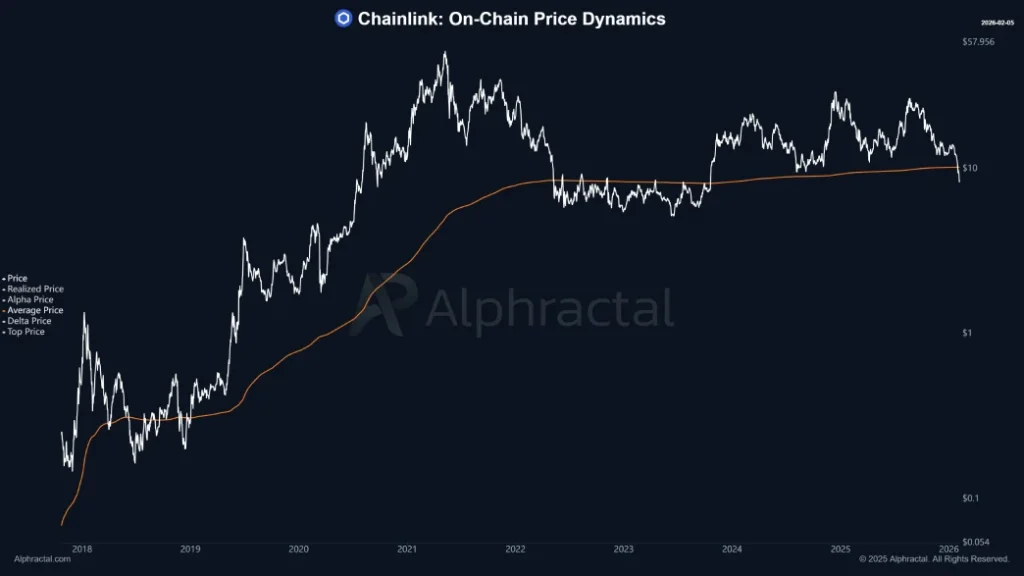

On Thursday, February 5th, the crypto market witnessed a flash crash which extended correction in the majority of major cryptocurrencies including LINK. The Chainlink price plunged over 14% and lost its double-digit value to reach $8.1. The coin price also breaks below key on-chain level, indicating that a majority of token holders are at loss, signaling a risk of continued weakness in buyers’ conviction.

On-Chain Signals Suggest Months of Sideways Action for LINK

The first week of February 2026 was disastrous for the cryptocurrency market, witnessing major breakdown from key cryptocurrency and cascading liquidation. The pioneer cryptocurrency Bitcoin plunged to a low of $62,200 on Thursday, while ETH dives below the $1,800 mark.

This crash wiped out over $860 billion in market value during the week, marking one of the largest value losses in crypto history.

Following the momentum, Chainlink price gave a decisive correction from $11.13 to current trading value of $7.85, registering a loss of nearly 30%. Consequently, the asset market cap tumbled to $5.2 billion.

Recent on-chain readings for Chainlink show that one of the key structural levels in internal capital flow metrics has broken down. Network-based capital rotation has been trending outwards for a long time so the implication is that the participants are reallocating rather than compounding in the ecosystem.

This shift seems to be visible with realized-cap momentum, NUPL positioning and smoothed on-chain price bands which have flattened since 2022. Historical parallels illustrate that when these measures weaken simultaneously, Chainlink price shifts its trajectory sideways to recouped bullish momentum rather than instant recovery.

Sporadic rallies may interspersed this time, fueled by cycles of liquidity or broader market movements, but they have often dissipated without renewed inflows of networks. The dominant pattern is representative of a slow recalibration phase that might extend out months or years.

Despite the risk of a prolonged sideways to bearish trend, Chainlink reserve continued to bag more LINK tokens. Earlier today, the strategic token reserve accumulated over the 125,454.48 LINK on Thursday, bringing its total holdings to 1.9 million LINK.

According to the official dashboard this takes the total to 1899,670.39 LINK, purchased at an average price of $15.73 per token. The current estimated worth of these holdings is somewhere in the $15.2 – $16.3 million USD range depending on the fluctuations of the market at the time of estimation.

The mechanism pulls tokens from two primary sources: payments made offchain by major institutional users integrating Chainlink’s oracle services, and fees collected directly onchain by decentralized applications leveraging its data feeds, automation and cross-chain capabilities.

Chainlink Price Poised For Relief Rally Before Next Downswing

With an intraday loss of over 14%, the Chainlink price gave a decisive breakdown below the support trendline of a long-coming falling wedge pattern. Since August 2025, the two converging trendlines of the wedge acted as dynamic resistance and support to LINK traders, driving a steady correction to price.

The recent breakdown below the bottom support indicates aggressive nature of sellers to drive a prolonged correction. However, the post-breakdown fall could show a temporary relief rally to $9 and retest the breached trendline as potential support.

The momentum indicator RSI at 22% highlights an oversold outlook, bolstering the potential for a bullish rebound in price.

If sustained, the sellers could force an extended correction below $7 support, followed by a dip to $5.64.

Also Read: Circle Partners with Polymarket to Build USDC Infra for Users

Credit: Source link