A worrying pattern has formed in the crypto sector. Reports say that about four in five projects hit by major hacks do not fully recover. Money is lost, yes. But the deeper damage is often to trust — and that can be fatal.

Related Reading

Trust Erodes Fast

When a breach is found, users pull funds quickly. Partners step back. Liquidity dries up. Industry experts, including Immunefi CEO Mitchell Amador, warn that slow or unclear responses can push entire communities away.

Some projects try to fix code quietly. That can fail. Silence is sometimes treated as hiding. Panic spreads. Confidence drops.

“Nearly 80% of projects that suffer a hack never fully recover,” Amador pointed out. The primary reason, he said, is not the initial loss of funds, but the “breakdown of operations and trust during the response.”

How Teams Respond Can Decide Fate

Reports note that incident plans are rare and that the absence of a clear playbook hurts more than the bug itself. A quick, honest update can calm people. A slow, confused reaction makes things worse.

In many cases, even after the technical flaw is fixed, the project stays damaged because users left and did not return. Some teams are rebuilt under new names. Others never regain attention. The human side of recovery matters a lot.

Amador said many protocols freeze once an exploit comes to light. According to him, teams often underestimate how exposed they are and lack the operational readiness needed to handle a serious security breach.

Security Problems Are Changing

The attacks are not all the same. Smart contract bugs remain a big cause. But now simple human errors, like leaked keys or social tricks, are also common.

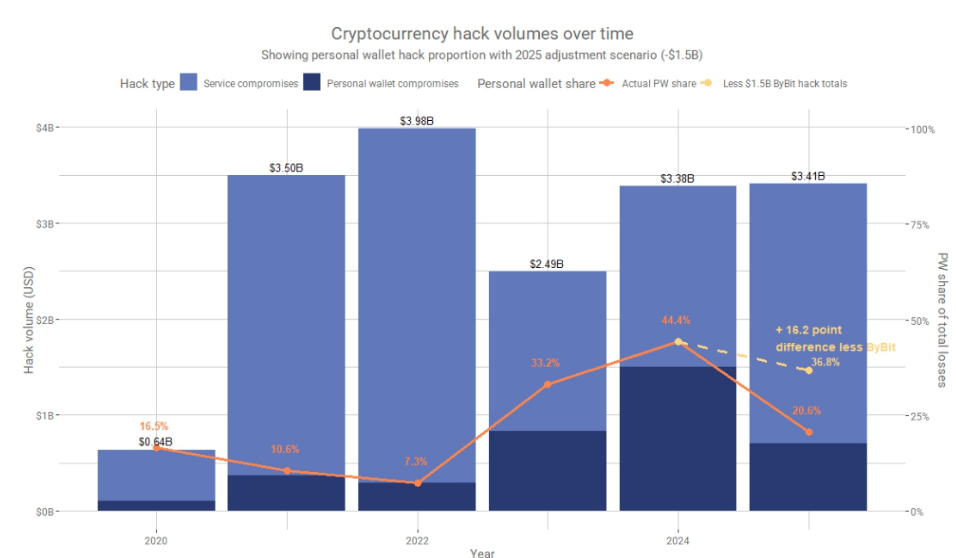

Reports say that losses in recent years have grown into the billions, with one figure around $3.4 billion lost in a single year. That number shows the scale of the risk.

Community Reaction Shapes Outcomes

A project can be technically repaired. But the people who used it may have moved on. Communities are fragile. Some founders try to refund users or set up funds to cover losses.

That can help. Other teams decide to close down the service and focus on other work. The decision is sometimes made for them when liquidity vanishes and partners cut ties. Recovery is often not just a technical task; it is a rebuild of trust and reputation.

Data from Chainalysis shows the $1.4 billion Bybit hack accounted for almost half of crypto losses in 2025.

Related Reading

Huge Damage

Crypto hacks jumped sharply in 2025 as attackers hit both large platforms and private wallets. Based on reports, total losses reached $3.4 billion, the biggest annual figure since 2022.

Just three breaches were responsible for nearly 70% of that damage by early December, with the $1.4 billion Bybit exploit standing out as the largest.

Featured image from Unsplash, chart from TradingView

Credit: Source link