Key Highlights

- CME Group is launching regulated futures contracts for three major altcoins, including Cardano (ADA), Chainlink (LINK), and Stellar (XLM), with trading expected to begin on February 9

- However, the launch of altcoin futures contracts still needs regulatory approval

- In order to mimic the nature of crypto markets to client demand, the exchange is planning to bring its entire crypto derivatives business to a near 27/7 trading model in early 2026

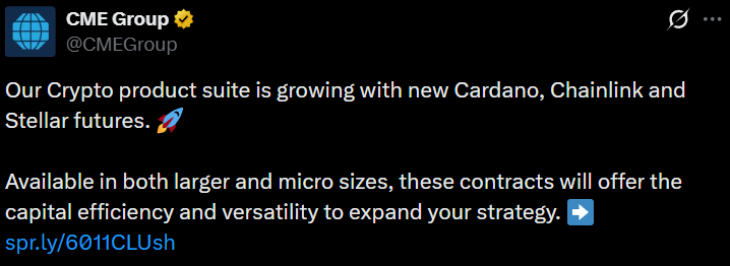

The CME Group, the leading global derivatives exchange, is taking a huge step as it announced its plan to launch futures contracts for 3 major digital assets, including Cardano (ADA), Chainlink (LINK), and Stellar (XLM). This expansion comes alongside a major shift to nearly nonstop trading for all its crypto products.

(Source: CME Group on X)

CME Group Expands Its Institutional Bridge into Crypto

The new futures contracts for ADA, LINK, and XLM are scheduled to start trading on February 9, 2026, after receiving final approval from regulators. CME Group stated that each cryptocurrency will have two types of contracts, which are a standard size for large institutions and a smaller “micro” version aimed at a broader range of traders, including retail investors.

Specifically, the standard ADA contract will be for 100,000 ADA, while the Micro ADA contract will be for 10,000 ADA. On the other hand, for LINK, the sizes are 5,000 LINK and 250 LINK. The XLM contracts will be for 250,000 Lumens and 12,500 Lumens.

These new future contracts will be cash-settled. It means that traders will profit or lose based on price changes without ever directly holding the actual cryptocurrencies. This provides a regulated way for investors to hedge against price swings or simply gain exposure to these altcoins.

“Given crypto’s record growth over the last year, clients are looking for trusted, regulated products to manage price risk as well as additional tools to gain exposure to this dynamic market,” Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products, stated in the press release. “With these new micro- and larger-size Cardano, Chainlink, and Stellar futures contracts, market participants will now have greater choice with enhanced flexibility and more capital-efficiencies.”

“Wedbush recognizes the continued maturing of regulated crypto futures contract listings,” Bob Fitzsimmons, Executive Vice President, Wedbush Securities Inc, said. “We are happy to continue supporting CME Group’s expansion of its product list, both for retail and institutional clients.”

“Digital assets are reaching a global inflection point as they become increasingly mainstream and more deeply integrated into investors’ portfolios,” Martin Franchi, CEO of NinjaTrader, said. “Today’s announcement from CME Group marks a watershed moment for the futures industry, creating more innovative and accessible on-ramps for traders seeking crypto exposure. As futures trading continues to grow in popularity among retail investors, we’re excited to be part of this shift and to help provide traders with greater choice and flexibility. With demand for these products continuing to rise, we’re thrilled to be part of this new frontier.”

“CME Group has yet again set the standard in innovation with their expansion into these offerings,” said Justin Young, CEO and Co-Founder of Volatility Shares. “As one of the world’s largest traders of crypto futures, Volatility Shares is excited to see more regulated financial products available for trading and risk management.”

CME Group Plans to Enhance Crypto Trading with Longer Hours

Amid the boom in the crypto market, CME Group has confirmed that it is planning to move its entire cryptocurrency futures and options business to a near 24/7 trading schedule. The global exchange revealed this plan in October 2025, which currently seeks regulatory review. If approved, trading on the CME Globex platform would run all week, pausing only for a brief period of maintenance on weekends.

Traders executed over the weekend, from Friday evening through Sunday, will be officially recorded with the next business day’s date for clearing and settlement.

This change is designed to match CME’s marketplace with the never-closing nature of the global crypto spot markets. The launch of ADA, LINK, and XLM futures in February could come with the start of this new, around-the-clock trading model.

The exchange reported record-breaking volumes throughout 2025. The total value of open positions reached a peak of $39 billion on September 18. In the third quarter of 2025, the average daily trading volume hit 840,000 contracts, accumulating its total value of over $14 billion.

Also Read: Ethereum Price Smashes Key Resistance as New Wallets Hit All-Time High

Credit: Source link